My Teller app for iPhone and iPad

Developer: Omer Rafiq

First release : 27 Jul 2015

App size: 3.88 Mb

As soon as you start spending your own money, it’s time to start tracking your spending so that you can create and follow a personal budget. Tracking your spending, while sometimes tedious, is the best way to find out exactly where your money is going.

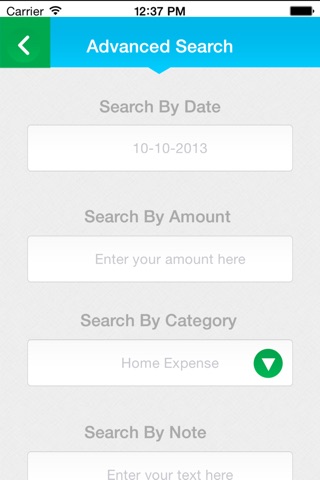

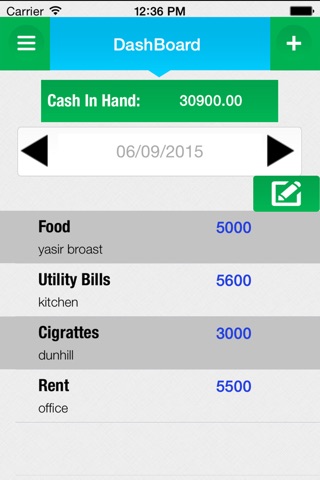

The simplest way to track your spending, especially your cash, is now within your hand, with our simple to use Mobile App. By carrying around your Mobile with you, you can track exactly where every dollar is going–from a small coffee on your way to work to a spending splurge at the mall. If you’d prefer, on a daily, weekly basis, or monthly basis is made possible with our Mobile App.

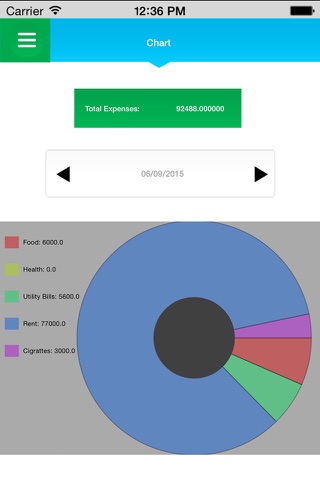

Once you have collected information for about a month, you’ll have a good baseline of information to use to create your personal budget. Some major categories that you’ll want to include are housing, utilities, insurance, food (groceries and dining out), gasoline, clothing, entertainment, and “other". Using a very friendly user interface provided by our Mobile App, or other personal finance program, add up the expenses that you’ve been tracking, and then calculate what you’d like to budget for each category. Keep in mind that you’ll need to budget for some items, like gifts and automobile repairs, which will be necessary but won’t occur every month. You can either create a budget for each individual month, with variances for irregular expenses (e.g., heating expenses which will be higher in winter months, or car repairs and gifts), or a standard monthly budget where you include an average amount for expenses such as car repairs, heating, and gifts.